Bold, ambitious and alive with opportunity – the creation of the ASEAN Economic Community could transform the economies of ASEAN countries. As the new economic powerhouse takes shape, UHY Global looks at the prospects for businesses in and beyond the region.

Growing populations of people with spending power and proximity to key markets already make the ASEAN region look promising, and now the new ASEAN Economic Community (AEC) is expected to help open up this market of 632 million people and a combined GDP of almost USD 3 trillion. Furthermore, free trade agreements with China, Japan, Korea, Australia, New Zealand and India put ASEAN and the AEC in the centre of a global supply chain with strong connections to the major Asian economies.

ASEAN, originally created as a political alliance to control the spread of communism in Southeast Asia, now has ten member states – Brunei Darussalam, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam. The association has a far greater influence on trade, politics and security issues than its members could hope for individually.

Last year, two important milestones were reached that put ASEAN countries en route to having greater potential impact on global trade. The first was the integration of accountancy services, a development covered in the previous issue of UHY Global. The second was the launch on 31 December 2015 of the AEC, which aims to create a single market and production base – albeit respecting national differences.

Battling BRICS

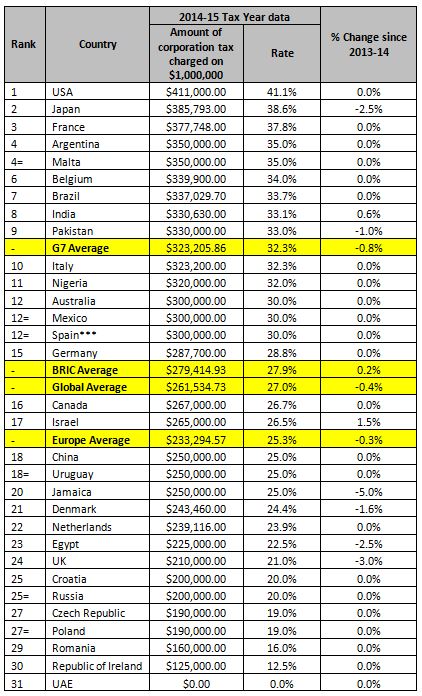

The arrival of the AEC looks set to see a shift in international economics – not least because the BRICS countries are losing their shine thanks to a slow-down in China, falling commodity prices in Russia, and South Africa, India and Brazil struggling with massive current account deficits, political uncertainty and currency volatility.

Diversity is one of the draws. Markets such as Cambodia, Laos and Myanmar, which manufacture low-value goods for export, have been barely touched by foreign investors. Vietnam has become a hub for textiles and footwear, while Malaysia is strong on both commodities and technology. Indonesia also has a huge commodities base, while Singapore is the region’s financial hub and home to high value industries such as pharmaceuticals and IT. Supporting these industries is a labour force with skills to match.

Steven Chong, partner, UHY Malaysia, who is based in Kuala Lumpur, is excited by the potential of the AEC.

“The AEC is projected to become the fifth largest economy in the world by 2018. Successful integration – or even semi-successful – would mean immediate growth potential for all sorts of businesses fuelled mainly by the increasing purchasing power within the region,” says Steven.

Is it still too early, though, for businesses to put the AEC on their radar for trade and growth? Steven says it comes down to timing and good execution. “Members of the AEC are very different in their stages of market maturity. Depending on the type of product or service that a business is involved with, I believe there’s a suitable market for all, by virtue of the fact that the ASEAN marketplace is so diverse.

“The most obvious opportunity, as I see it, would be in the manufacturing sector,” he adds. “We’re already seeing lots of manufacturing facilities moving to, or setting up, in the Mekong region. While this phenomenon has arisen because it’s a low-cost region for manufacturing, ASEAN’s young population, coupled with urbanisation and an increase in purchasing power, would also fuel opportunities in consumer products and services.”

Strength and resources

While the AEC brings nations together, the bloc should not be thought of as homogenous.

Businesses considering ASEAN need to remember that members are culturally diverse in terms of language, religion, customs and work etiquette. The strategy and allocation of their resources should always reflect the characteristics of the ASEAN nation a business is interested in working in.

For businesses in the region already, the AEC is a passport to working closely together to develop a strong and unified economic bloc. Companies can capitalise on each other’s strengths and resources, while operating in a region that already shows immense potential to generate sustained consumption of products and services well into the next 50 years, with a combined population second only to China and India.

Bob Gill is General Manager for Southeast Asia at ARC Advisory Group, the leading technology research and infrastructure advisory business. He sees the AEC as a work in progress, but one with huge promise.

“Even before the arrival of the AEC, Southeast Asia was becoming an increasingly relevant part of the global economy. By 2020, GDP is forecasted to exceed USD 4 trillion, and by 2030, USD 9 trillion,” he says. “Increasingly, industries are being established and expanded to meet rising levels of affluence, as more people drive cars, choose convenience foods, take modern medicines, and desire brand-name personal care items and everything that goes with the consumer lifestyle.

“While many areas of the world, including China, face shrinking and ageing populations, Southeast Asia is set to see the addition of some 114 million inhabitants between now and 2035. Crucially, this population growth is accompanied by a demographic dividend in the form of an increasing working-age population, which is critical to growth.”

This all means businesses beyond ASEAN should definitely have the region on their radar, and the opportunities, says Bob Gill, are broad.

“Consumer-based industries such as auto, personal and household care items, food and drink, pharmaceuticals and chemicals may benefit from the growing population and a rising middleclass. Infrastructure industries – cement, airports, ports, roads, rail and telecoms – are likely to be in demand as the region develops. Energy companies – oil, gas and power-related – will be needed to meet the increasing energy needs of industries and consumers.”

The potential for Southeast Asian companies will expand, he believes, thanks to the region becoming much more interlinked and cohesive. Internally, for example, the removal of tariffs and non-tariff barriers should reduce business costs and promote trade.

“Companies can look forward to being part of a region that is becoming prominent on the world stage. Note, for example, the first ever US-ASEAN Summit held in February 2016 and hosted by President Obama.”

Work in progress

There are, however, challenges as well as opportunities. The first is the enormous disparity in terms of levels of development and market sophistication. The second is that some nations are less open to foreign workers, which can have an impact if a company needs to upskill but lacks a management team that can transfer expertise. The third is infrastructure.

In Singapore, infrastructure development has boosted GDP growth, but Indonesia, Cambodia, Laos and Myanmar are finding that their growing economies are outstripping transport networks – and the result can be seen in supply chain bottlenecks.

Analyst and researcher Elodie Sellier, writing for The Diplomat, an online international news magazine for the Asia-Pacific region, also highlights the many remaining barriers to free trade.

“Consumer laws, intellectual property rights, land codes and investment rules have yet to be harmonised at the regional level,” she says, “while the lack of common, integrated banking structures, alongside the absence of an agreement on common and acceptable currencies, are likely to hinder market access for regional small and medium-sized enterprises.”

However, ASEAN is committed to building an investment environment to attract businesses. The ASEAN Comprehensive Investment Agreement (ACIA) includes commitments to liberalise and protect cross-border investments and sets out best practices for how foreign investors and investments are treated.

Michael Aguirre, managing partner, UHY M.L. Aguirre & Co. CPAs in the Philippines, would like to see reforms around non-tariff barriers and a reduction in the amount of red tape companies have to deal with. He also believes that failing to harmonise tax rules and the ease of doing business could lead to intra-ASEAN competition in terms of attracting investments.

“The introduction of structural reforms nationally and taking bold actions regionally will further deepen economic integration,” says Michael. “Now, more than ever, the private sector needs to take a greater interest and play a larger role in shaping ASEAN and the AEC in ways that will benefit not only the people of Southeast Asia but also the emerging economies of the world.

“Sectors such as accounting and advice services, aerospace, engineering, manufacturing and legal services present untapped business opportunities for thousands of companies across the ten member states. Most have been ignored in the past, but AEC’s framework is geared towards achieving the long-term development aspirations of its members and provides a channel for borderless economic activities.”

UHY member firms across the region are in agreement that Southeast Asia is brimming with potential, offering hugely interesting and promising trading opportunities – perhaps even the most important since the global financial crisis. As the AEC takes shape, it’s clear that businesses wanting to grow or expand should have ASEAN on the radar.

For more information on UHY’s member firms throughout the Asia-Pacific region, visit www.uhy.com.

Notes for Editors

Press contacts:

Dominique Maeremans

Tel: +44 20 7767 2621, or email: d.maeremans@uhy.com