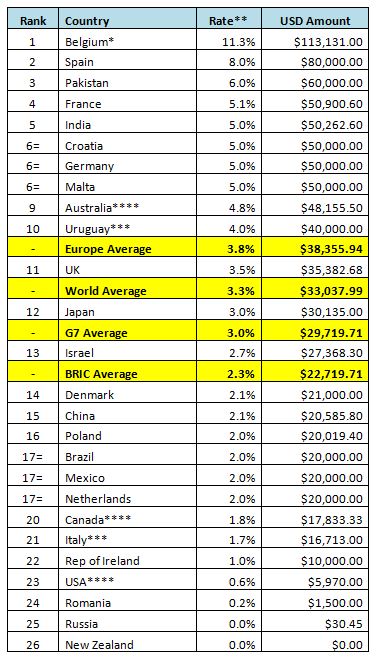

European economies levy some of the highest property purchase taxes in the world on prime real estate, charging on average 4%, or USD 38,356, in tax on a property purchase of USD 1 million, reveals a new study by UHY, a leading international accounting and consultancy network.

UHY says that major European economies including France, Germany, and Spain levy among the highest property purchase taxes in the world (see table below).

UHY says that although high property taxes are an attractive source of revenue for governments, they could risk discouraging labour market mobility and valuable overseas investment from High Net Worth individuals.

UHY’s findings show that Belgium has the highest average property taxes for real estate worth USD 1 million of any country in the study at 11.3%* – a charge of USD 113,131.

Other western European economies at the top of the table include France and Germany, charging USD 50,901 and USD 50,000 respectively on residential property transactions worth USD 1 million.

This is far higher than the global average of 3.3% (USD 33,038) for properties in this price bracket.

By contrast, many other advanced economies have far lower property purchase tax rates on prime real estate. For instance although the rate can vary across states, the US levies just 0.6% on average (USD 5,970) and Canada charges an average of 1.8% (USD 17,833).

Ireland also charges significantly lower taxes than its Western European neighbours at just 1% (USD 10,000).

UHY tax professionals studied tax data for individuals purchasing a house worth USD1 million in 26 countries across its international network, including all members of the G7, as well as key emerging economies.

UHY says that while the G7 economies charge on average 3%, (USD 29,720) – broadly in line with the global average – tax charges in the BRIC economies are around a third lower at 2.3% (USD 22,720).

New Zealand and Russia have the lowest taxes in the table, effectively charging 0% on prime property purchases.

New Zealand has no central or local government transaction taxes on real estate and residential property deals between home owners, as they are exempt from the government’s Goods and Services tax. Similarly Russia imposes no transfer taxes on the buyer, who only pays a minor fixed amount of State Duty of around USD 30.

Comments Bernard Fay, Chairman of UHY: “European economies continue to see property purchase taxes as a rich seam and a good way to bolster public finances which remain under intense strain. However, governments should be careful not to over-exploit it.”

“Higher property purchase taxes can also put a strain on domestic buyers, who may not actually be particularly wealthy, given house price inflation in some locations over the last decade or two.”

UHY points out that in the Netherlands the government reduced the Real Estate Transfer Tax in 2011 from 6% to its current 2% to help stimulate the housing sector for buyers. The lower rate is only applicable to residential property, with the higher 6% remaining for non-residential property.

Bernard Fay continues: “Levying significant taxes on the cost of a new property could constrain labour market mobility. If businesses have to offer much greater incentives for employees to relocate, this could have a serious impact on job creation and business investment in that country, and ultimately on its wider economy.”

UHY adds that in many countries, including Italy, Spain, and Uruguay, property purchase taxes are calculated using the value of the property in government registries, but these prices can often differ from the market value.

Comments Andrea D’Amico of UHY Advisor Srl in Italy: “Prime properties, especially in capitals, such as Paris or Berlin, are particularly desirable for wealthy investors from overseas, but excessively high taxes could make these markets less attractive. There’s a risk that they could lose out to locations such as New York where purchase taxes are seen as more reasonable.”

“These wealthy overseas investors contribute to the local economy in many other ways, through discretionary spending while they are staying in the property, as well as maintenance costs, for instance by refurbishing extensively, or employing staff.”

RESIDENTIAL PROPERTY TRANSFER TAXES FOR THE PURCHASER OF A PROPERTY WORTH USD$1,000,000

* This figure represents an average of the rates in Brussels, Flanders, and Wallonia which can vary from 9.8% to as high as 12.5%.

**Rates rounded to nearest tenth

***Rate paid on cadastral value of property, not market price; for Italy (based on 2015 data), it includes the law with the provision that the rate applies on the cadastral value of the property, which is largely lower than the market price

****Average of local variations

.